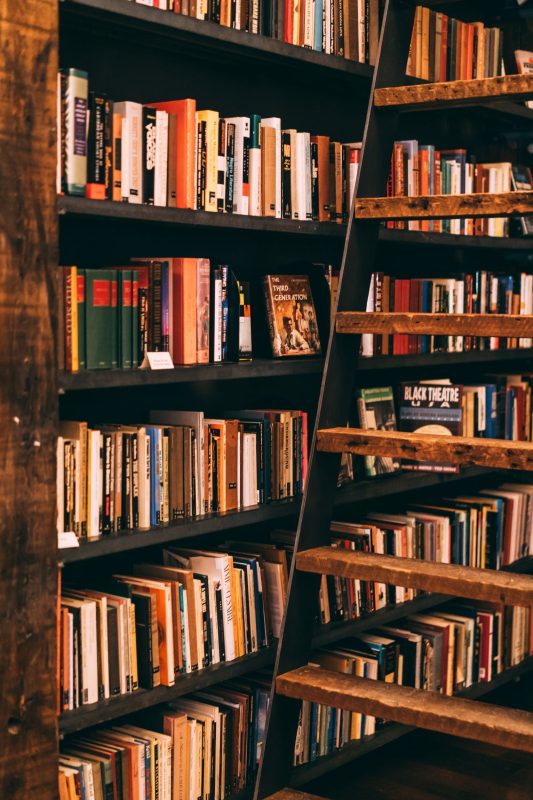

Periodic tax declaration and compliance

Timely and accurate submission of monthly, quarterly, and annual tax returns not only helps businesses avoid legal risks but also reflects transparency and professionalism in financial operations. For foreign-invested enterprises or those operating across borders, strict compliance with tax regulations and proper management of tax obligations are critical for maintaining reputation and sustainable operations.

Consult now